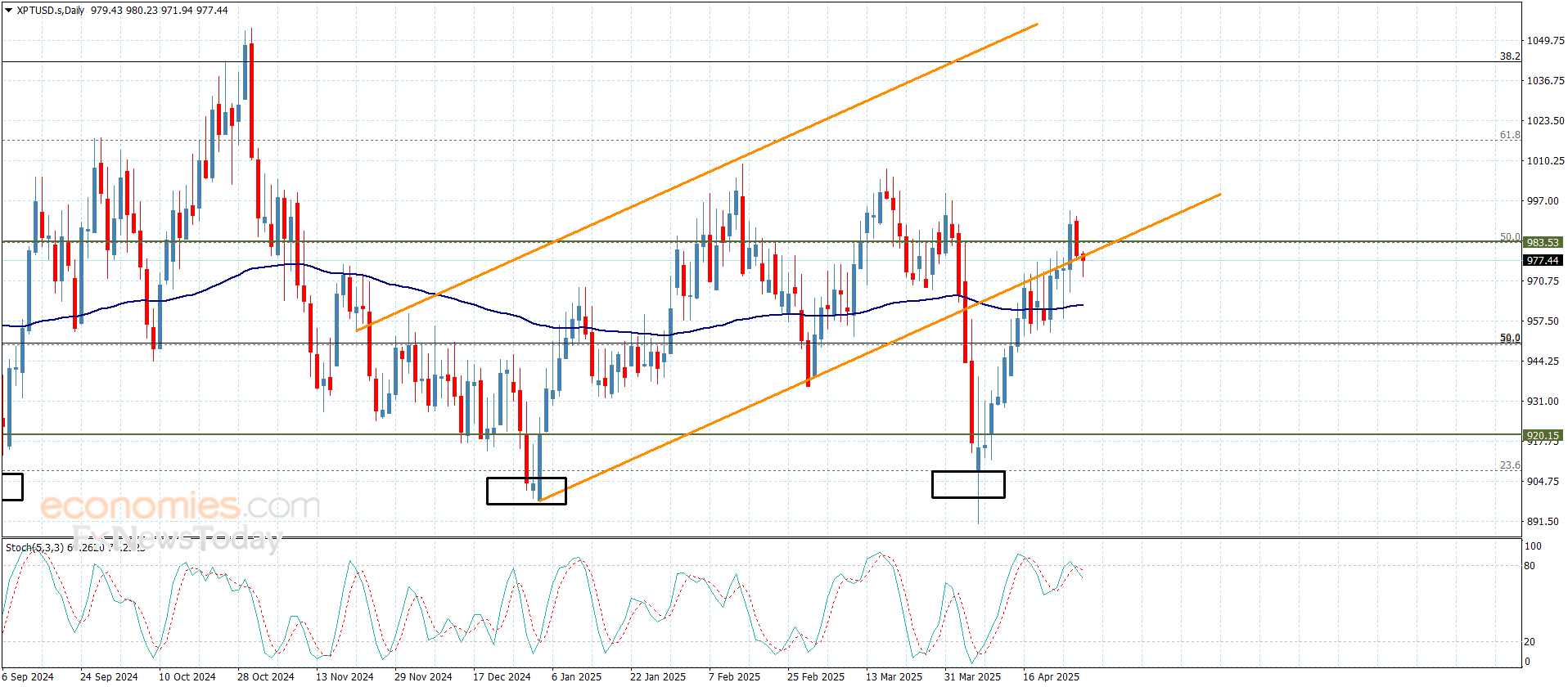

Platinum price returns to the sideways trading– Forecast today – 30-4-2025

Platinum price returned to the sideways trading due to its decline below $983.00, affected by the contradiction between the main indicators, especially stochastic exit from the overbought level, which forces it to decline towards $975.00.

Note that forming lower top that the previous tops reinforces forming a new bearish track, to expect attacking the moving average 55 at $961.00, then attempts to press on the extra support at $950.00, while providing a positive close above $1000.00 level will confirm its move to the bullish track again.

The expected trading range for today is between $961.00 and $990.00

Trend forecast: Bearish

Do you need help in trading decisions? Do you want to learn how to start trading?

Join Economies.com VIP Club and benefit from over 15 years of market analysis expertise and get:

- Full coverage of commodities such as gold, oil, silver, and more

- Full coverage of all major forex currency pairs

- Full coverage of key global indices and stocks

- Full coverage of major cryptocurrencies and meme coins

- Accurate analysis and daily updated price forecasts

- Exclusive and breaking news

- Reliable trading ranges for effective risk management

- Comprehensive educational materials, competitions and prizes!

- Innovative tools to enhance your trading performance

Special Offer: Subscribe to the Economies.com VIP channel and get also a free subscription to a trusted trading signals channel provided by Best Trading Signal.

Copper price moves away from the obstacle– Forecast today – 30-4-2025

Copper price provided new negative close near $4.7500 level, to confirm the continuation of the suggested bearish scenario, depending on the stability below the barrier at $4.9100, despite the continuation of the previously main indicators contradiction, remains valid to keep waiting for reaching 50%Fibonacci correction level at $4.6600, and breaking it will lead the price to provide strong pressures on the moving average55 near $4.5400.

The expected trading range for today is between $4.6600 and $4.8400

Trend forecast: Bearish

Do you need help in trading decisions? Do you want to learn how to start trading?

Join Economies.com VIP Club and benefit from over 15 years of market analysis expertise and get:

- Full coverage of commodities such as gold, oil, silver, and more

- Full coverage of all major forex currency pairs

- Full coverage of key global indices and stocks

- Full coverage of major cryptocurrencies and meme coins

- Accurate analysis and daily updated price forecasts

- Exclusive and breaking news

- Reliable trading ranges for effective risk management

- Comprehensive educational materials, competitions and prizes!

- Innovative tools to enhance your trading performance

Special Offer: Subscribe to the Economies.com VIP channel and get also a free subscription to a trusted trading signals channel provided by Best Trading Signal.

GBPUSD attempts to gain positive momentum -Analysis-30-04-2025

The (GBPUSD) price witnessed calm downside moves in its last trading on the intraday levels, affected by the stability of the critical resistance at 1.3420, and the main overview remains prefer the positivity, especially with the stability of the price above EMA50, which reinforces the chances for a bullish rebound any moment, to attempt to gain positive momentum that might assist it to breach this resistance.

The continuation of the trading alongside a bullish bias line on the short-term basis, besides the emergence of the positive signals on the (RSI), suggesting a potential regain for the positive momentum, which increases the possibilities from breaching the mentioned resistance.

Do you need help in trading decisions? Do you want to learn how to start trading?

Join Economies.com VIP Club and benefit from over 15 years of market analysis expertise and get:

- Full coverage of commodities such as gold, oil, silver, and more

- Full coverage of all major forex currency pairs

- Full coverage of key global indices and stocks

- Full coverage of major cryptocurrencies and meme coins

- Accurate analysis and daily updated price forecasts

- Exclusive and breaking news

- Reliable trading ranges for effective risk management

- Comprehensive educational materials, competitions and prizes!

- Innovative tools to enhance your trading performance

Special Offer: Subscribe to the Economies.com VIP channel and get also a free subscription to a trusted trading signals channel provided by Best Trading Signal.

USDJPY succeeded in offloading its oversold conditions -Analysis-30-04-2025

The (USDJPY) price settled on sideways fluctuated range in its last trading on the intraday levels, after leaning on the support of EMA50, providing some of the positive momentum, which makes the price succeed to offload the oversold conditions that appear on the (RSI), and the negative signals begin to emerge, which shows the continuation of the negative pressures on the price, amid the domination of the main bearish trend on the short-term basis and trading alongside trendline.

Do you need help in trading decisions? Do you want to learn how to start trading?

Join Economies.com VIP Club and benefit from over 15 years of market analysis expertise and get:

- Full coverage of commodities such as gold, oil, silver, and more

- Full coverage of all major forex currency pairs

- Full coverage of key global indices and stocks

- Full coverage of major cryptocurrencies and meme coins

- Accurate analysis and daily updated price forecasts

- Exclusive and breaking news

- Reliable trading ranges for effective risk management

- Comprehensive educational materials, competitions and prizes!

- Innovative tools to enhance your trading performance

Special Offer: Subscribe to the Economies.com VIP channel and get also a free subscription to a trusted trading signals channel provided by Best Trading Signal.